All Categories

Featured

Table of Contents

There is no one-size-fits-all when it revives insurance policy. Obtaining your life insurance policy strategy right considers a number of aspects. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your active life, monetary independence can seem like an impossible goal. And retirement may not be leading of mind, due to the fact that it appears thus far away.

Less employers are providing typical pension plan plans and many business have actually decreased or terminated their retirement strategies and your ability to count solely on social protection is in inquiry. Even if benefits haven't been reduced by the time you retire, social safety alone was never meant to be adequate to pay for the lifestyle you want and should have.

Currently, that might not be you. And it is necessary to recognize that indexed universal life has a whole lot to provide people in their 40s, 50s and older ages, as well as individuals that desire to retire early. We can craft a solution that fits your certain situation. [video: An illustration of a man appears and his wife and child join them.

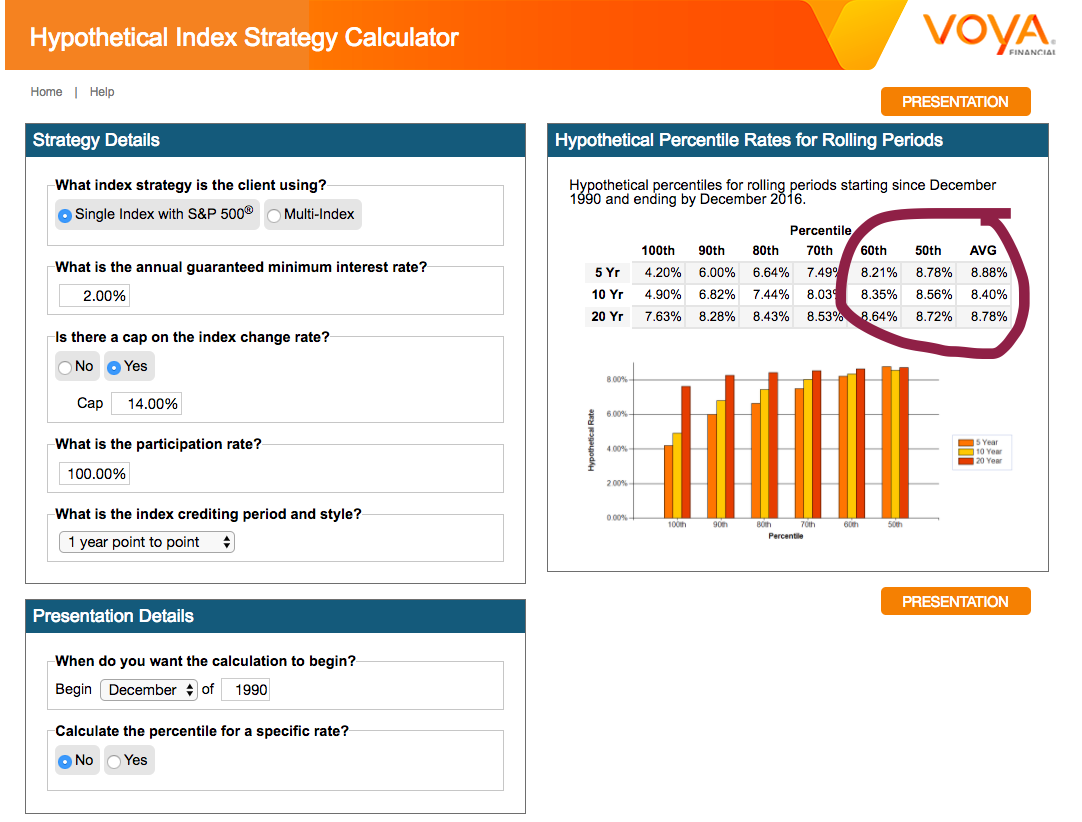

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, expect this 35-year-old male requires life insurance to secure his household and a way to supplement his retired life income. By age 90, he'll have gotten nearly$900,000 in tax-free income. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And should he die around this time around, he'll leave his survivors with even more than$400,000 in tax-free life insurance advantages.< map wp-tag-video: Text boxes appear that read"$400,000 or even more of security"and "tax-free income with plan lendings and withdrawals"./ wp-end-tag > Actually, throughout all of the accumulation and disbursement years, he'll get:$400,000 or even more of security for his heirsAnd the chance to take tax-free earnings via policy finances and withdrawals You're probably wondering: Exactly how is this feasible? And the solution is straightforward. Interest is linked to the performance of an index in the stock exchange, like the S&P 500. The money is not straight invested in the stock market. Passion is attributed on an annual point-to-point segments. It can give you a lot more control, versatility, and alternatives for your financial future. Like many individuals today, you might have accessibility to a 401(k) or other retirement. Which's a wonderful primary step towards conserving for your future. It's vital to recognize there are restrictions with certified plans, like 401(k)s.

And there are restrictions on when you can access your money without penalties. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take cash out of a certified strategy, the cash can be taxed to you as revenue. There's a good factor many individuals are turning to this unique remedy to fix their financial goals. And you owe it to yourself to see exactly how this can work for your very own personal scenario. As component of a sound economic technique, an indexed universal life insurance policy plan can help

Universal Life Insurance Providers

you take on whatever the future brings. And it offers unique possibility for you to develop significant cash money value you can utilize as extra income when you retire. Your cash can grow tax delayed through the years. And when the policy is made properly, circulations and the fatality advantage won't be tired. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is necessary to talk to a specialist agent/producer who understands just how to structure a solution such as this properly. Prior to dedicating to indexed global life insurance, here are some advantages and disadvantages to think about. If you select an excellent indexed universal life insurance coverage plan, you may see your cash worth grow in value. This is helpful since you might be able to accessibility this cash prior to the strategy runs out.

Low Cost Universal Life Insurance

Since indexed universal life insurance policy requires a specific degree of threat, insurance companies often tend to keep 6. This kind of strategy also provides.

Normally, the insurance business has a vested interest in carrying out far better than the index11. These are all variables to be considered when choosing the finest kind of life insurance policy for you.

Iul Life Insurance Meaning

Nonetheless, because this kind of policy is extra complicated and has an investment element, it can often come with greater premiums than other plans like whole life or term life insurance policy. If you don't think indexed global life insurance is best for you, below are some alternatives to take into consideration: Term life insurance policy is a short-lived policy that generally uses coverage for 10 to three decades.

Indexed global life insurance is a sort of plan that offers extra control and adaptability, along with higher money worth growth capacity. While we do not supply indexed global life insurance policy, we can provide you with even more information concerning whole and term life insurance policy plans. We recommend discovering all your choices and talking with an Aflac agent to uncover the ideal fit for you and your household.

The remainder is contributed to the cash money worth of the policy after fees are subtracted. The cash value is attributed on a month-to-month or annual basis with passion based upon rises in an equity index. While IUL insurance coverage may prove useful to some, it is essential to comprehend exactly how it works before acquiring a policy.

Table of Contents

Latest Posts

No Lapse Universal Life

Indexation Insurance

What Is Index Life Insurance

More

Latest Posts

No Lapse Universal Life

Indexation Insurance

What Is Index Life Insurance