All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your hectic life, economic independence can seem like a difficult goal.

Less employers are supplying standard pension plan strategies and several companies have minimized or terminated their retirement plans and your capability to count entirely on social safety is in question. Even if benefits haven't been decreased by the time you retire, social safety and security alone was never ever meant to be enough to pay for the way of life you desire and deserve.

/ wp-end-tag > As part of a sound financial method, an indexed global life insurance policy can assist

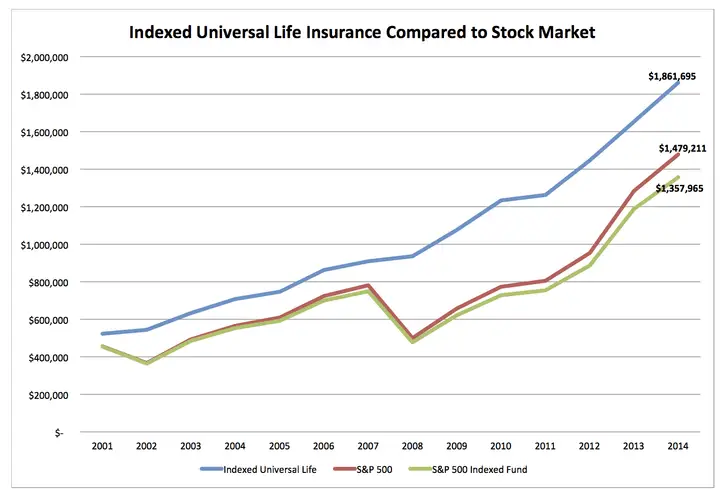

you take on whatever the future brings. Before committing to indexed global life insurance, here are some pros and cons to consider. If you choose a great indexed global life insurance strategy, you might see your cash money worth expand in value.

Indexed Insurance Policy

If you can access it at an early stage, it might be helpful to factor it right into your. Because indexed universal life insurance policy calls for a particular degree of danger, insurer often tend to keep 6. This sort of plan likewise uses (iul as a retirement vehicle). It is still assured, and you can readjust the face amount and riders over time7.

If the picked index does not do well, your money value's growth will certainly be impacted. Commonly, the insurance provider has a beneficial interest in executing much better than the index11. There is usually a guaranteed minimum passion rate, so your strategy's development won't drop below a specific percentage12. These are all factors to be thought about when selecting the very best type of life insurance policy for you.

Ul Accounts

Nonetheless, because this sort of plan is a lot more complex and has a financial investment component, it can usually come with greater premiums than other plans like entire life or term life insurance policy. If you don't believe indexed universal life insurance is right for you, below are some alternatives to consider: Term life insurance coverage is a temporary plan that commonly uses protection for 10 to three decades.

When making a decision whether indexed global life insurance coverage is ideal for you, it is very important to take into consideration all your choices. Whole life insurance policy may be a better choice if you are seeking more stability and consistency. On the other hand, term life insurance policy might be a much better fit if you just require coverage for a specific time period. Indexed global life insurance policy is a type of plan that provides much more control and adaptability, along with greater money value growth capacity. While we do not provide indexed universal life insurance policy, we can supply you with even more details about whole and term life insurance coverage plans. We advise checking out all your choices and talking with an Aflac agent to discover the very best suitable for you and your family.

The remainder is added to the money value of the policy after costs are deducted. While IUL insurance coverage might prove important to some, it's crucial to recognize just how it functions prior to acquiring a plan.

Latest Posts

No Lapse Universal Life

Indexation Insurance

What Is Index Life Insurance